Table Of Content

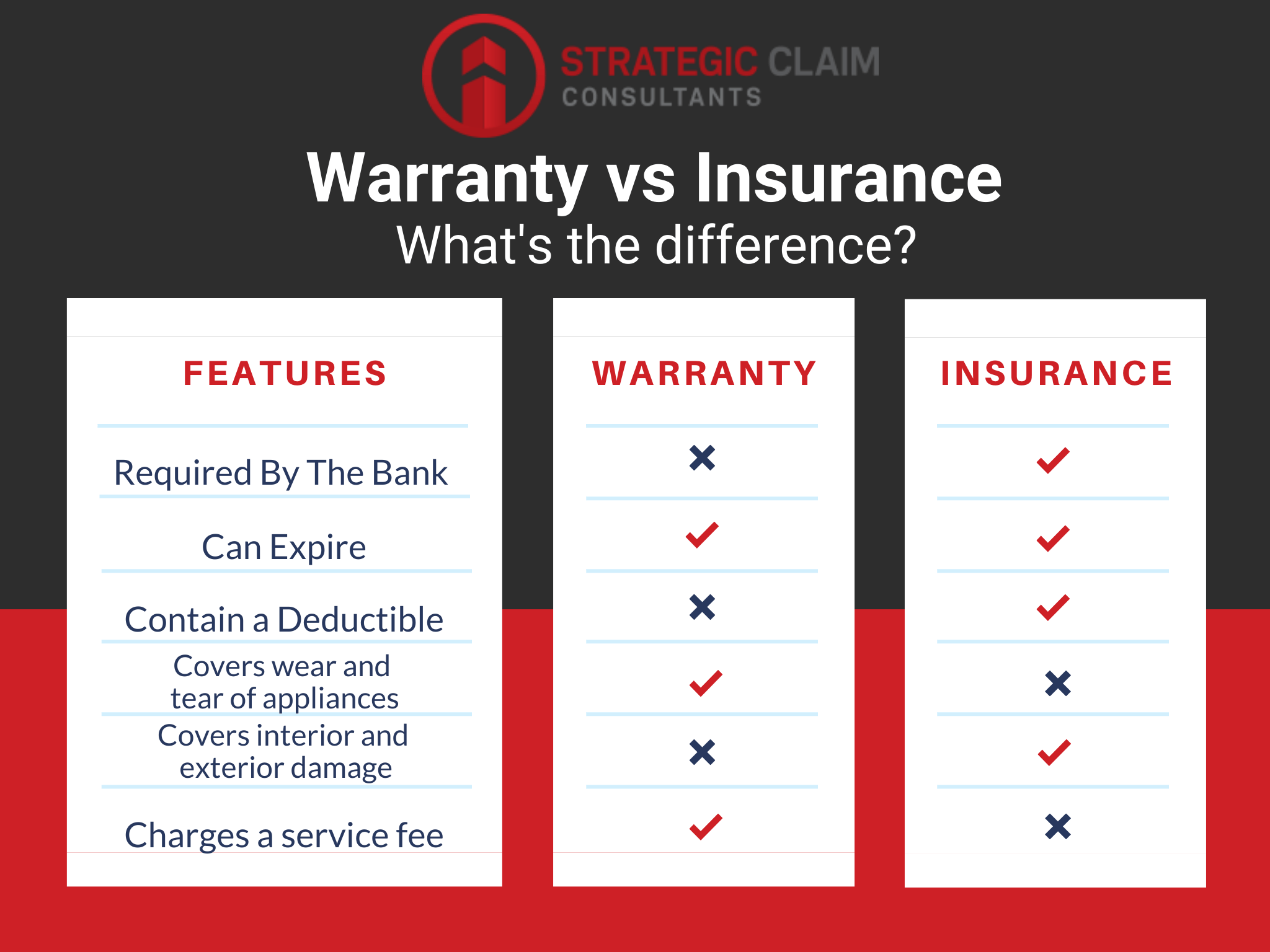

If a tree falls on a home or a neighbor backs into a garage door, a home warranty can’t help—but the best homeowners insurance often can. Warranties are limited to covering events that happen due to age or natural wear and tear. First, we chose the elements of the best home warranties that we wanted to consider. Coverage options and limits, pricing, customer service options, packaging, and the details in the fine print were determined to be the most critical aspects when selecting a home warranty company. Cinch Home Services stands out among the best home warranty companies as coverage includes pre-existing issues, rust, corrosion, and sediment as part of each policy’s standard terms.

Don’t Worry. Be Warranty.

Read your contract thoroughly for exclusions for preexisting conditions and a waiting period before you purchase coverage. A great way to protect the big investment you made by owning a home. Over time, the systems and appliances we rely on most will inevitably break down.

Best Systems Plan: Cinch Home Services

Policies may also stipulate what that fee covers; most often, the fee is per event. If a washing machine needs to be repaired, for instance, but the technician needs to order the part and return on another day to install it, the service fee will cover both visits and the cost of the part. Some companies limit how many technician visits can be covered by one service charge, after which another service charge is applied. Homeowners can ask their chosen home warranty companies how their service fees work to make sure they fully understand what they may need to pay when filing a claim. It’s a good idea for homeowners to understand their budget as they begin to compare companies and products.

What Do Home Warranties Cover?

In any of these scenarios, a home warranty can lessen homeownership expenses by providing necessary repairs and replacements or reimbursing you for approved claims. A home warranty is worth it for the peace of mind of knowing that your most-used home items aren’t your sole responsibility. Enrolling in a home warranty plan can take the pressure off finding a reliable contractor because all you have to do is request service, pay the service fee, and someone will contact you. A team member also purchased a plan to test its customer service and claims process. It's reassurance when covered systems and appliances stop working in your home.

The Home Service Club

” for instance—can provide more insight into the merits of home warranty policies geared toward California homes and properties. Discounts are fairly common among home warranty providers, but not all companies will offer such opportunities. In some cases, warranty savings and discounts may not be significant enough to have a big impact on the total cost of coverage. That being said, homeowners may find that they can greatly reduce the price of their home warranty by taking advantage of certain discounts. We added or removed additional points based on average service fees and customer representative responsiveness. After signing up, the waiting period until a home warranty plan takes effect is usually 30 days.

However, once the time has elapsed, customers may be required to pay a second fee to schedule another appointment. As such, a longer workmanship guarantee can offer more peace of mind to homeowners and could save them money in the long run. Based on the companies included in this round-up, the average monthly cost of a home warranty in North Carolina is $55, with service fees ranging from $60 to $150. However, prices may vary with other providers, so it may be worthwhile to compare home warranty plans from a number of companies. ARW Home features a 30-day workmanship guarantee for all completed repairs.

The Best Home Warranty Companies in Wyoming 2024 - MarketWatch

The Best Home Warranty Companies in Wyoming 2024.

Posted: Mon, 15 Apr 2024 07:00:00 GMT [source]

In addition, Cinch provides various coverage caps depending on the item. Elite Home Warranty offers three coverage plans and a fully customizable plan. You can choose from a $100 or $130 service fee on its annual plans.

What is the best home warranty company?

Pricing models for home warranties are based on a policyholder’s choice of coverage, the service charge selected, and any additional coverage added to the plan. Policyholders can expect to pay between $264 and $1,425 a year (or an average of $600) for home warranty coverage. If a homeowner wants to file a claim and schedule a technician, they’ll need to pay an additional service fee for each event, which can run anywhere from $55 to $150 depending on the company. For instance, every policy covers malfunctions stemming from rust, corrosion, and sediment buildup, which is not always the case with a home warranty.

The Bottom Line: The Best Home Warranties Plans Offer Priceless Peace Of Mind

With American Home Shield, customers can unlock extensive HVAC coverage, with even the most basic plans offering $5,000 of coverage on this critical home system. This is a very high coverage limit, which may allow homeowners to cover expensive HVAC repairs and replacements without having to contribute funds out of pocket. All American Home Shield plans also cover pre-existing conditions, provided they cannot be detected through a simple visual inspection or mechanical test. Coverage on pre-existing conditions is not always available with home warranties, so this standard inclusion may allow homeowners to get more use out of their home warranty with American Home Shield.

These home warranty providers scored the highest in our review standards. The listings that appear are from companies from which this website receives compensation, which may impact how, where and in what order products appear. This listing does not include all companies or all available offers and products. Alongside government oversight, home warranties are self-regulated by industry associations. For example, the National Home Service Contract Association (NHSCA) is a nonprofit industry trade organization consisting of member companies that follow a code of ethics around fair business practices. Attorney Arthur Chartrand, who is of counsel to the NHSCA, states that member companies undergo background checks and a top-down review that analyzes how companies handle claims before being listed as members.

Waiting periods can often run for about a month, but in some cases, new customers may need to wait even longer before their coverage begins. Several home warranty companies offer coverage for roof leak repair due to normal wear and tear. This means the company will patch just the damaged area, and it won’t cover replacement for the entire roof.

No comments:

Post a Comment